Backtesting means trading in simulation on historical trade data from exchanges to test your strategies. One advantage of using WolfBot in the cloud is that we have years of combined trading data from exchanges available, so for many popular currency pairs you can start backtesting immediately (instead of having to wait for days to import them)

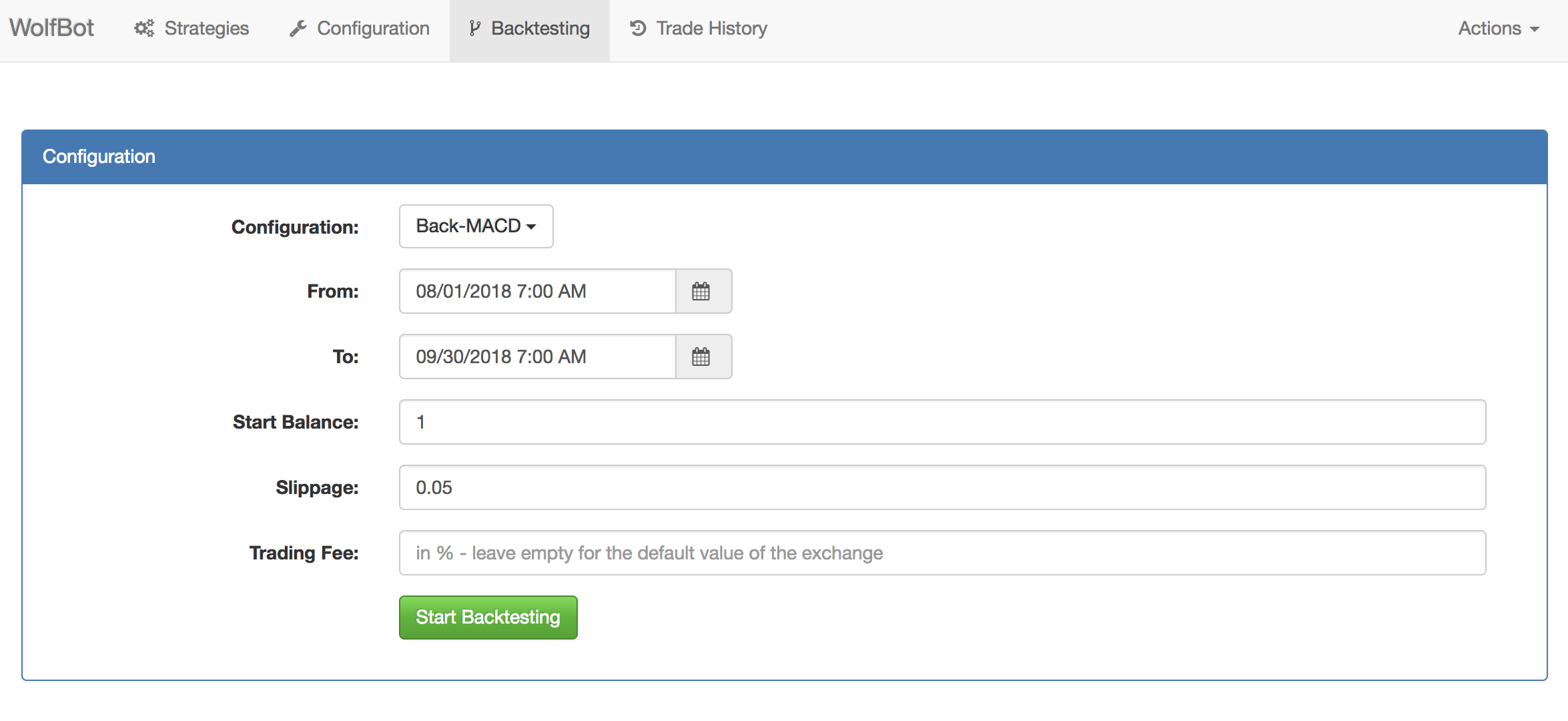

After you have configured your trading strategies, you can open the “Backtesting” page to do so:

In the above example we created a configuration named “Back-MACD” and test in on the trades of the whole month of August 2018.

Backtesting uses the same configuration as live trading, so it’s easily comparable and needs only a few inputs such as:

- The time range you want to trade on. We recommend 1-4 weeks to check if your strategy is successful in a particular market. Once you are happy with the results you can increase and/or change the time period.

- the starting balance for your simulation (in the base pair of your coin. So if you trade BTC_ETH, this will be 1 BTC in the Screenshot, if you trade USD_BTC this will be 1 USD)

- optional: slippage, only for expert traders trading bigger positions

- optional: trading fee, usually not relevant when trading with small amounts. We recommend using the default values per exchange (already set).

All other configuration is set on the Configuration page (as for live trading). In particular

- the currency pair you want to test

- the exchange you want to run your backtest on

- if you want to enable margin trading (leveraged trading). This allows WolfBot to do short-selling during backtests.

- the strategies you want to use

- all parameters for your strategies

With WolfBot you can run run backtests to improve your strategies while trading in live mode – even on the same currency pair and exchange. The two modes will not interfere with each other.

View detailed instructions and ask questions on how to do backtesting in our forum.